20 Dec From Depression to Living My Dreams: How I Prepared to Live Around The World. Part 1 of 3

Christmas time is my favorite time of the year! In fact, I am one of those people that would put up a Christmas tree in September if I knew that my family and friends would not harass me. I love everything about Christmas, the decorations, singing Christmas carols, giving gifts, Santa Claus, watching old Christmas movies…. I mean everything. I’m getting distracted just thinking about it.

However, the Christmas season of 2014 was quite different. I did not have my usual over zealous excitement about Christmas. Yes, I put up a tree, but I neither hosted nor attended one party. I bought very few gifts and I was sleeping more than usual. I struggled getting out of bed everyday for several weeks.

I lay awake many nights pondering what was wrong with me. I could not understand why I could not get into the Christmas spirit. I could no longer ignore that I was not happy with my life. I did not like the long hours I worked at my 6-figure corporate job. I felt socially stagnant and the Chicago winters were killing me. I was over going to the same social events seeing the same people. And I really didn’t look forward to the obtuse commentary from my family at family gatherings about my single status. I was stressing about everything. I felt like I desperately needed a change.

So, I began to revisit the dream that I had in my twenties of living outside of the United States. I asked myself many questions: How am I going to move? How much will it cost? Where will I go? What will I pack? What will I do with my stuff? What am I going to do when I get there?

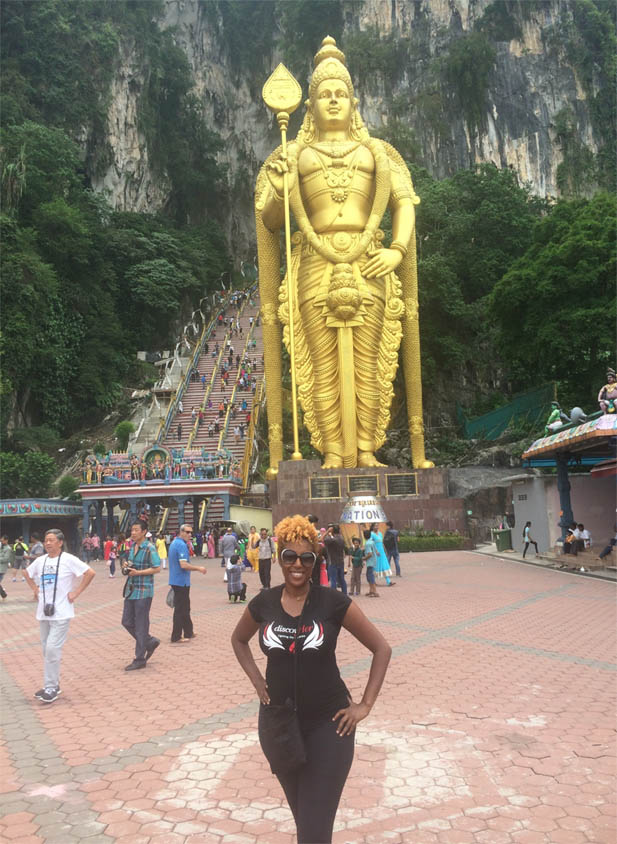

Well, I answered all of these questions and more. As of this blog post, I have traveled to 29 countries this year! This has been the most exciting and fulfilling time of my life. I AM LIVING MY DREAMS! Many people have asked me how I did it so I’m finally slowing down enough to share. Please join me for this three part blog series.

Batu Caves, Malaysia

How I saved $30,000 to fund my dream of living around the world.

I have never been an ultra saver. I did save money for a rainy day, but I never really researched the best prices before making major purchases, clipped coupons or thrift store shopped. I’m more of a goal saver. Once I meet my savings goal, I spend how I want to. I’m sharing this because I think it is important to know yourself and what motivates you. It’s so funny to me that I accomplished saving $30,000 because if you would have asked me or my financial planner 6 years ago if I could do it, we both would have emphatically said no! In fact, my financial planner tried to put me on what I thought was a strict budget and I had a full anxiety attack and started crying.

However, saving for this trip was different. I felt like my life would be changed forever by taking this trip. Therefore, I was willing to do whatever it took to make it happen. I suggest asking yourself WHY you want to save money. Because knowing your WHY will keep you motivated far longer than just saying you want to accomplish something.

[bctt tweet=”Knowing your why will keep you motivated longer than saying you want to accomplish something.” username=”MableTaplin”]

1.Set a savings goal.

It’s funny when I started writing this list, I forgot to add this one. In my opinion, this is the most important item on the list. Establishing goals help me stay motivated. Setting a Smart Goal is even better. A smart goal is a goal that is measureable and has a timeline attached. I set a goal of saving $30,000 in 1 year. Broken down by quarters, that is $7500 every three months. Which is $2500 per month or $625 per week. In full transparency, I did not always meet my goal. However, knowing how much I missed it by at the end of the month, helped me make informed decisions about my spending the next month. In order to keep myself motivated to stay disciplined, I would treat myself to a gift less than $100 if I met my savings goal for the quarter.

Download Your Savings Worksheet

2.Establish a separate bank account.

I researched accounts that met certain criteria. These criteria were:

- Online Banking

- No Foreign Transaction Fees

- No minimum balance requirement

- No Atm Fees

- Downloadable phone app

I purposely did not activate the ATM cards. This decreased any temptation that I would’ve had to withdraw money. Two banks that I recommend are: Charles Schwab or Capital One.

Download Your Resource List

3.Establish a set amount to be automatically withdrawn from your checking account and deposited into your savings account the same day as payday.

(Save $150 every two weeks) I set the withdrawal date for payday so I would not be tempted by seeing the money in my account.

4.Establish automatic withdrawal from your check by your employer and deposit into the savings account once a month.

I set the withdrawal date for the second paycheck of the month, because I paid my bills with the first paycheck. (Save $200)

5.Sign up for savings apps that automate saving small amounts by rounding up on purchases.

6.Decrease bills that are not a necessity.

- Disconnect Cable (Save $128 per month) No Power or Game of Thrones for me! Netflix and Chill it is. I have compiled a list of cable alternatives for you.

- Disconnect Internet (My job gave me a portable Wifi pack.)

- Disconnect Home Alarm (Save $44 per month) (My house was really secure. I had security doors and rolling shutters. Nobody was getting in! Plus my brother lived four blocks away.)

- Disconnect Home Phone (Save $35 per month) I only used the home phone in case my alarm went off.

- Decrease gym membership from nationwide elite membership to basic membership (Save 50 per month) I only used the gym in my neighborhood anyway so no big deal.

- Paid off recurring credit card bill which was $2500 (Saved $200 per month payment)

7.Decrease personal care maintenance schedule.

- Stopped wearing weaves and I went from getting my hair done weekly to once a month. (Saved $398 per month)

- Decreased frequency of getting no chip manicures and pedicures every two weeks to getting a mani/pedi once a month on the special day ($25 for both). (Saved $82 per month)

- Invested in getting laser hair removal for my lip, chin, under arms and lower legs. Total one time cost, $1128 vs. $140 per month (Saved $552)

8.Sell clothes, shoes and household items that you no longer wanted or needed.

Whoever said there was money hanging in your closet was a genius. I had no idea how many pairs of shoes I owned or how many formal dresses I had with the tags still on them. Below are the vehicles that I used to sell my stuff. (earned $5000)

- Smart Phone apps that I used to sell clothes and shoes.

-

- Offerup

- PoshMart

-

- The Real Real https://www.therealreal.com

- Local Consignment Shops- (I was in Chicago so here are a few in Chicago.)

-

- Plump Chicago https://www.facebook.com/plumpchicago/

-

- Consignment groups on Facebook

- Neighborhood Side Walk Sale

- Home and Yard Sale (I turned my living room into a boutique for two Saturdays.)

My Yard Sale

9.Decrease housing expenses.

I sold my condo and moved in with my girlfriend for 6 months. (Saved $9000) Ahem this was a big one! I moved from a three bedroom/two bath condo to a room in someone’s house with a shared bathroom. I had never lived with anyone as an adult. My girlfriend is a saint!

10.Deposit Federal Tax return directly into my savings account.

I reduced my deductions to zero once I decided that I wanted to save money. Talk to your accountant and find out if this is an option for you. ($2000 refund went straight to the savings account.)

11.Saved two of my bonus checks for two quarters.

I set up an extra automatic withdrawal from my checking account on the date that my bonuses were due to be paid.

[bctt tweet=”I believe that dreams really can come true! I AM LIVING MY DREAMS!” username=”MableTaplin”]

Heeey! You made it to the end of this first part. I know I have given you a lot of information and I have tons more. I feel compelled to share because I want you to LIVE YOUR DREAMS! You can save money! You can experience real joy and freedom! Start today!

Make a commitment to do at least two things on this list!

Don’t forget to download the Resource List!

Download Your Resource List

GIRL LET’S GO! I want to hear about what you plan to start doing today to work toward living your dream. Send me an email at Mable@discovher or comment below.

Share this blog post with your family and friends!

No Comments